The Problem With Grants

Grants are a great start, but they don't take advantage of the superpower of blockchain. We can do better.

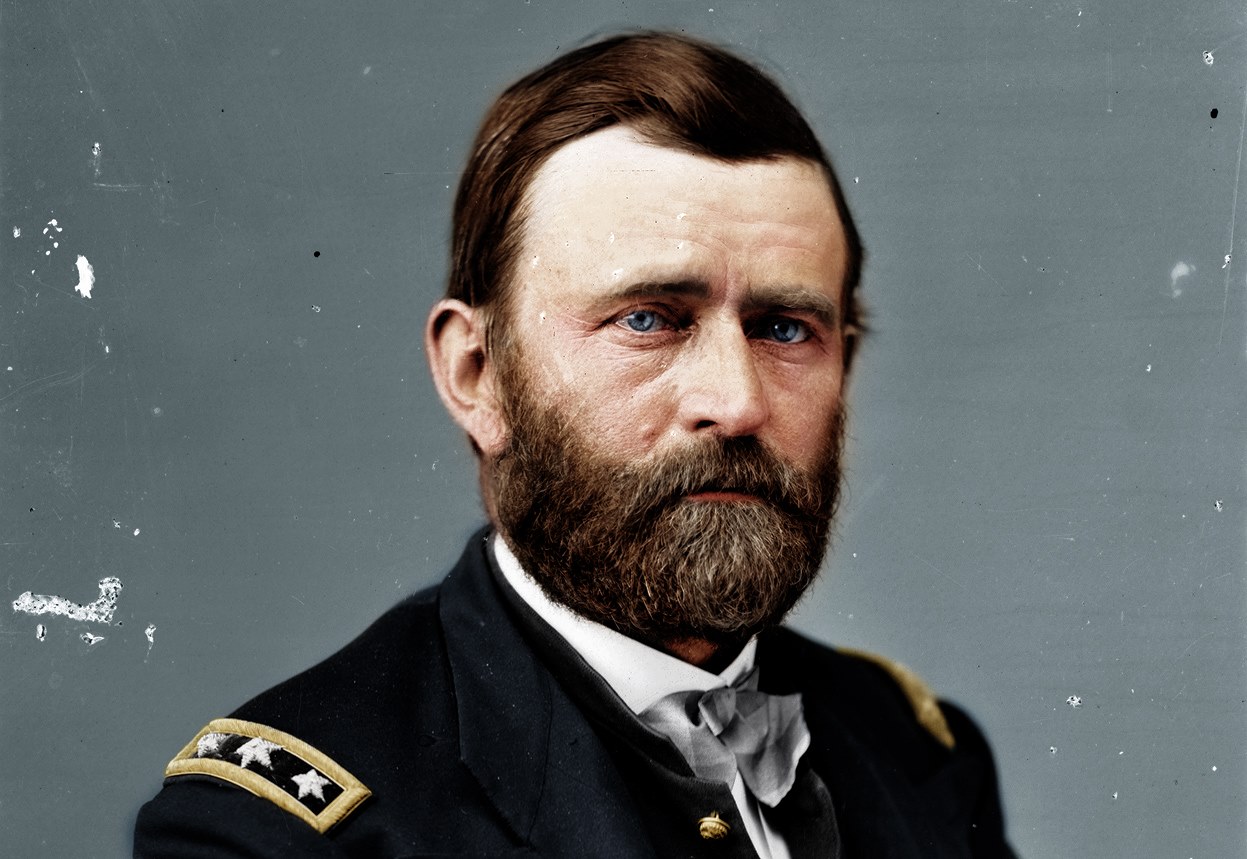

Here is one famous Grant: General Ulysses S. Grant. He is not the source of our problems. In fact, he has very little to do with blockchain, but this is a great photo. Would you ask this guy for money? (Image source)

I wrote recently about blockchain economics, and about the unfortunate tendency of many projects and founders not to reserve a meaningful share of wealth and influence in a network for later arrivals and contributions. One of the things I hear most often in response is, “We would never hand out tokens to random strangers. But we do give grants.” To continue the island allegory from that post, this is like saying, “We don’t want to let just anyone come to our island and we don’t want to share our wealth with just anyone. We want them to prove themselves first. We want them to earn it!”

On the face of it, this position sounds reasonable and enticing. But it’s also flawed. I’ll try to explain why.

Setting up a grants program sounds like the easiest thing in the world. What could be easier than giving out free money, right? Everyone thinks they are an expert, and yet everyone tends to make the same mistakes. I have yet to see a well-run grants program in the blockchain space.

In theory grants are great, and having a grants program, even a flawed one, is probably better than not having one. To the extent that grants distribute wealth and influence to a broader set of stakeholders, they definitely increase network value by increasing the number and diversity of stakeholders, supporting constructive contributions, etc..

The fundamental problem with grants, however, is that they tend to be very centralized. They work the way companies do: a company controls the agenda and resources, and hires someone to do something that it wants them to do, and in exchange it pays them for the work. That’s fine as far as it goes, but here’s the important point: it doesn’t take advantage of the superpower of blockchain, which is permissionless innovation.

As a result, grants are flawed for the same reason all centralized things are flawed. Founders use grants to further existing agendas. Each of us is a bundle of biases, preconceptions, and prejudices, and grants programs tend to reflect this fact. We tend to give grants first to people we already know and trust, then to people who are like us and the people we already know. We tend to give grants to people who think like us, and are working on the sorts of things we’d work on. Why? It’s just how we’re wired, and it feels less risky.1

Concrete examples (and counterexamples) are helpful. One of the largest grants programs in the space is run by the Ethereum Foundation, which has given out around $19M since beginning a grants program in 2018. While these grants have supported dozens of projects and teams around the world, some of the largest grants have been awarded to projects led by individuals who are close friends of Vitalik Buterin or other senior Foundation staff, as well as to projects they invested in. I don’t know how these decisions were made, and it’s possible that steps were taken to mitigate conflicts of interest, but if they were, they were never disclosed.

This sort of lack of transparency is a problem because it leads to a perception of bias, nepotism, and unfairness, and perception matters. Ambitious project teams may think they don’t stand a chance of receiving a grant since they don’t know any project insiders. As a result they may be turned off by such a grants process, or by such an ecosystem entirely. Remember, the blockchain space is values-driven: we’re here because we feel that existing systems are biased, unfair, and broken. Competition (along lines of community and values, as well as of technology) is increasing rapidly and teams looking to build blockchain applications now have many choices, and there are many projects willing to lure them in with funding.

Transparency is necessary and it’s certainly helpful, but it alone is not sufficient to make up for the lack of permissionlessness. The concept of permissionlessness is subtle and not well understood, even in the blockchain space. It matters so much because the most radical innovations tend to come out of left field, from whence we least expect them (for a lot more on this phenomenon, read about the Innovator’s Dilemma). If someone, typically a centralized organization such as a foundation, filters all incoming grant applications for whatever reason—to filter out spam, or for KYC/AML/risk management—that organization will almost certainly overlook the most exciting ideas because they’ll look weird, and they won’t make sense.

Even simply asking people to apply for a grant in the first place will filter out many applicants, because “neutral” isn’t actually neutral. What may look to you like a short, simple application form may in fact look quite daunting to a prospective applicant.2

In spite of these shortcomings, a grants program is still a valuable addition to a thriving ecosystem, especially if the program is well designed and well run. No grants program will be able to fully overcome these challenges since grants are by definition not permissionless. While it is possible to run a healthy grants program—see below for some suggestions how to do this—I also think it’s important to highlight that it is also possible to distribute wealth in a more permissionless fashion. At the end of the day, a grants program is a means of wealth distribution, and as existing blockchain experiments have taught us, getting even a little bit of stake into the hands of a lot of people goes a long way towards growing a community.

Proof of work mining is a great example of a truly permissionless and credibly neutral means of wealth distribution. I think people today fail to appreciate how important permissionless mining was in attracting the first (and maybe also second, and even third) generation of stakeholders to contribute to projects like Bitcoin and Ethereum. Any ambitious, curious seventeen-year-old, anywhere in the world, with access to commodity hardware and an Internet connection, could begin mining—without needing anyone’s permission—and become a fully-fledged peer in the network, with meaningful skin in the game. They didn’t need a credit card, they didn’t need to reveal their identity or go through a KYC/AML process, they didn’t need to understand how exchanges work, they didn’t need to buy a token from someone else. To a large extent, tokens acquired in this permissionless fashion bootstrapped these projects and continue to fund their development work today. And many people who got started this way would not have been likely to go through the process of applying for a grant, even if it had been possible at the time.

Of course, proof of work mining from home is no longer possible in all but the smallest and most obscure of projects. While other permissionless alternatives are emerging, they are novel and unproven at scale. I think an alternative, which is still underappreciated and hasn’t been utilized enough, is the airdrop. While an airdrop can be totally scattershot (e.g., giving tokens to all Ethereum accounts), being more targeted is probably a better strategy. HNS ran such an airdrop recently, successfully getting tokens into the hands of a few hundred thousand known developers, relevant organizations, and nonprofits—in other words, many parties that might feasibly become future stakeholders. Yes, there is still a degree of bias involved, and an opportunity for nepotism, but to the extent that such an airdrop targets a credibly neutral metric (such as “all GitHub developers with more than 15 followers”), I think it’s a pretty good start.

Where possible, wealth should be distributed in a permissionless fashion. In addition to that, or where that’s not possible, a grants program can still make a lot of sense. Here are some thoughts on how to design and run a healthy grants program.

Run the grants program as transparently as possible. A positive example here is the (now defunct) Aragon Nest program, where anyone could apply for a grant by submitting an issue on GitHub. All of the grants workflow was handled in an open GitHub repository, so anyone could see what was going on. Sunlight is the best disinfectant, and running your grants program in the open will go a long way towards reducing bias, nepotism, and other forms of bad behavior—and the perception thereof.

Declare conflicts of interest and what is being done to mitigate them. This has been standard practice in government, business, and academia for a long time and it should be self-evident why this is a good idea. Having a larger set of stakeholders and grant reviewers makes this easier, since anyone with a conflict of interest can recuse themselves from reviewing a particular grant application.

Involve the community. The larger and more diverse the group responsible for reviewing grant applications, the greater the likelihood you can avoid groupthink, homophily, and bias, and the greater the likelihood that good ideas won’t be overlooked. You have a fantastic resource at your disposal in the form of an engaged, enfranchised community—and a grants program is an excellent opportunity to give the community a meaningful role in an important ecosystem project.

Recruit expert reviewers. Many grant applications in the blockchain space tend to involve obscure and complex ideas in fields such as computer science, math, and cryptography. It helps a great deal to have individuals with subject matter expertise review these applications for relevance and competence. This is an excellent opportunity to involve the community, as described above: you can tap into a larger network of experts who would probably be happy to contribute their time and expertise.

The more grants programs, the better. One organization giving grants is better than none. Two is even better, and three better still. The more different people and organizations involved in the grants process, the more likely it will be perceived as legitimate, and the more likely it will be not to miss the next big thing. Different organizations can focus on giving grants to different sorts of teams pursuing different sorts of projects. Of course, this is just one example of why multipolar governance is beneficial.

Give out small grants, quickly. Many grants processes move slowly, taking months from the time an application is received to the time when the grant is actually paid. It takes time for institutional wheels to turn, approvals to materialize, KYC paperwork to be processed, etc. By the time such a long process is finished, many applicants will have given up and moved on. When in doubt, try to err on the side of giving smaller sums of money, faster: a $5k grant approved and paid in 24 hours is much better than a $25k grant that takes months. Best of all, this actually reduces long-term risk because it gives applicants an opportunity to show what they’re capable of and build trust, faster.

Relax the requirements and expectations. As described above, the most important innovations tend to come out of left field and from places where you least expect them. If you only award grants to, say, people you already know, those with a US bank account, etc., you will miss a lot of potential candidates and game-changing ideas. The best grants programs make room for weird, wonderful, wacky things to happen. Yes, this increases risk somewhat, but a good way to mitigate this risk is to give out smaller amounts of money, faster (see previous bullet point).

Give grants for things other than software. Building infrastructure, apps, and tooling is of course essential in the blockchain ecosystem, but other important work is often overlooked. This tends to include things like design, community building, project management, and event organizing. In order to encourage a healthy, active ecosystem, set an example by visibly funding valuable contributions of all sorts.

Offer ongoing support and guidance. Money is helpful, but many teams also lack expertise on things like product, marketing, HR, and business development. A little bit of sound advice can go a long way. Even though grants are not investments, strictly speaking, it’s prudent to approach your grants program as if you are making an investment—in the ecosystem, if not in a particular project. Like a good VC fund, consider offering your grantees mentorship, helping them with things like hiring and design, and actively connecting them with other grantees.

Offer ongoing financial support. A small grant is a great way to bootstrap a project and build trust, but most projects won’t become immediately profitable and will need to seek ongoing financial support. Whenever possible, follow up your initial grants by giving successful, high-potential projects additional grant funding. Once a project is mature enough to “graduate” from the grants program, such as after achieving product-market fit, making targeted introductions to angel investors and VCs can make a big difference. As mentioned above, thinking about your grants program less as charity and more as a strategic investment program is probably a good idea.

Have you applied for a grant before? What was the experience like? What have I missed? Tell me by leaving a comment, below!

[Update 5/12/2020: Adjusted wording to make it clear that the EF grants program is one of the largest, but is no longer the largest, in the space. Clarified thoughts on the distinction between grants programs and permissionless means of wealth distribution.]

-

In slightly more scientific terms, this is due to homophily (“this guy gets it!”) and various cognitive biases such as overoptimism (“this idea will definitely work so I need to recruit others who are onboard with it”), confirmation bias (“this person agrees so my idea must be valid”), groupthink (“everyone I know thinks so too”), and the mind projection fallacy (“this is clearly true so others must see it too”). In general, we tend to naively assume that others think the way we do, and see the world the way we do. That’s antithetical to innovation. It happens to be a serious problem for venture capital firms, too, many of which tend to be run by people who look, sound, think, and act a lot like one another, and who reenforce this groupthink by discussing investment ideas and theses, trading staff, etc.. ↩

-

Here is a partial list of ways this might happen, off the top of my head. I’m sure you could think of others.

- The form is in English, but the applicant doesn’t have a strong grasp of English.

- The applicant had a bad experience with another grant application process, and doesn’t want to go through it again.

- The applicant isn’t quite sure what they want to build, or doesn’t know quite how to articulate it.

- The application form is too long.

- The applicant prefers to be paid in crypto, but the grants program pays in fiat.

- The applicant is turned off by the idea of needing to ask someone else for approval, hat-in-hand, in the first place. Maybe, in their mind, they’d rather “work for themselves” than “work for someone else.”

- The applicant submits the form but misses a response email.

- By the time the applicant receives a response, they have already given up and moved on to work on something else.

- The form is designed for a modern desktop or laptop, but the applicant is using an old mobile phone.

- Filling out the form requires a Google account, or a GitHub account, or something else, but the applicant doesn’t have an account on this service and doesn’t want one.

- The applicant can’t load the application form due to connectivity issues, or a Great Firewall or the like.

- The applicant doesn’t want to use their legal name, reveal their location, etc. Often this is because of a non-compete or existing employment agreement, or IP issues with a university.

- The form requires an address, but the applicant doesn’t have a stable address.

- The application requires an email confirmation, but the applicant doesn’t use email.